Renters Insurance in and around Mattoon

Renters of Mattoon, State Farm can cover you

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It may feel like a lot to think through your busy schedule, keeping up with friends, work, as well as deductibles and coverage options for renters insurance. State Farm offers straightforward assistance and impressive coverage for your tools, sports equipment and cameras in your rented townhome. When trouble knocks on your door, State Farm can help.

Renters of Mattoon, State Farm can cover you

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

You may be wondering: Is renters insurance really necessary? Think for a moment about how difficult it would be to replace your stuff, or even just a few of your high-value items. With a State Farm renters policy in your pocket, you don't have to be afraid of abrupt water damage from a ruptured pipe. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've stored in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Sherri Branson can help you add identity theft coverage with monitoring alerts and providing support.

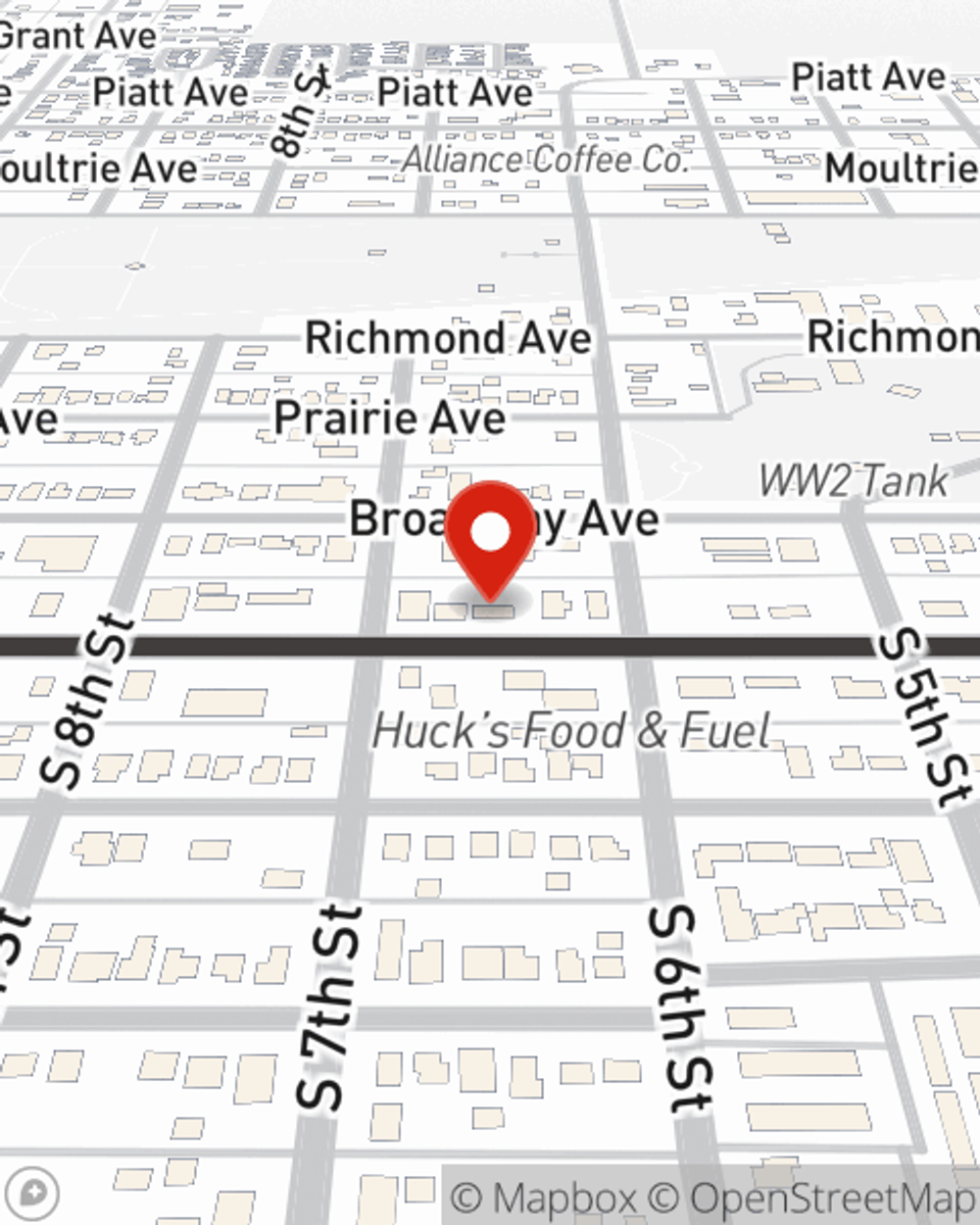

If you're looking for a value-driven provider that can help with all your renters insurance needs, reach out to State Farm agent Sherri Branson today.

Have More Questions About Renters Insurance?

Call Sherri at (217) 234-6467 or visit our FAQ page.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Sherri Branson

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.